Custom 1099 Tax Return Generator

$120.00$150.00 (-20%)

Features

-

Editable 1099-MISC and 1099-NEC templates

-

Reflects IRS-compliant layout and formatting

-

Perfect for freelancers, tax trainees, and accountants

-

Helps visualize non-employee income reporting

-

Fast and simple form generation

-

Secure and private data entry

-

Downloadable PDF output

-

Strictly for educational and professional training purposes

Product Description

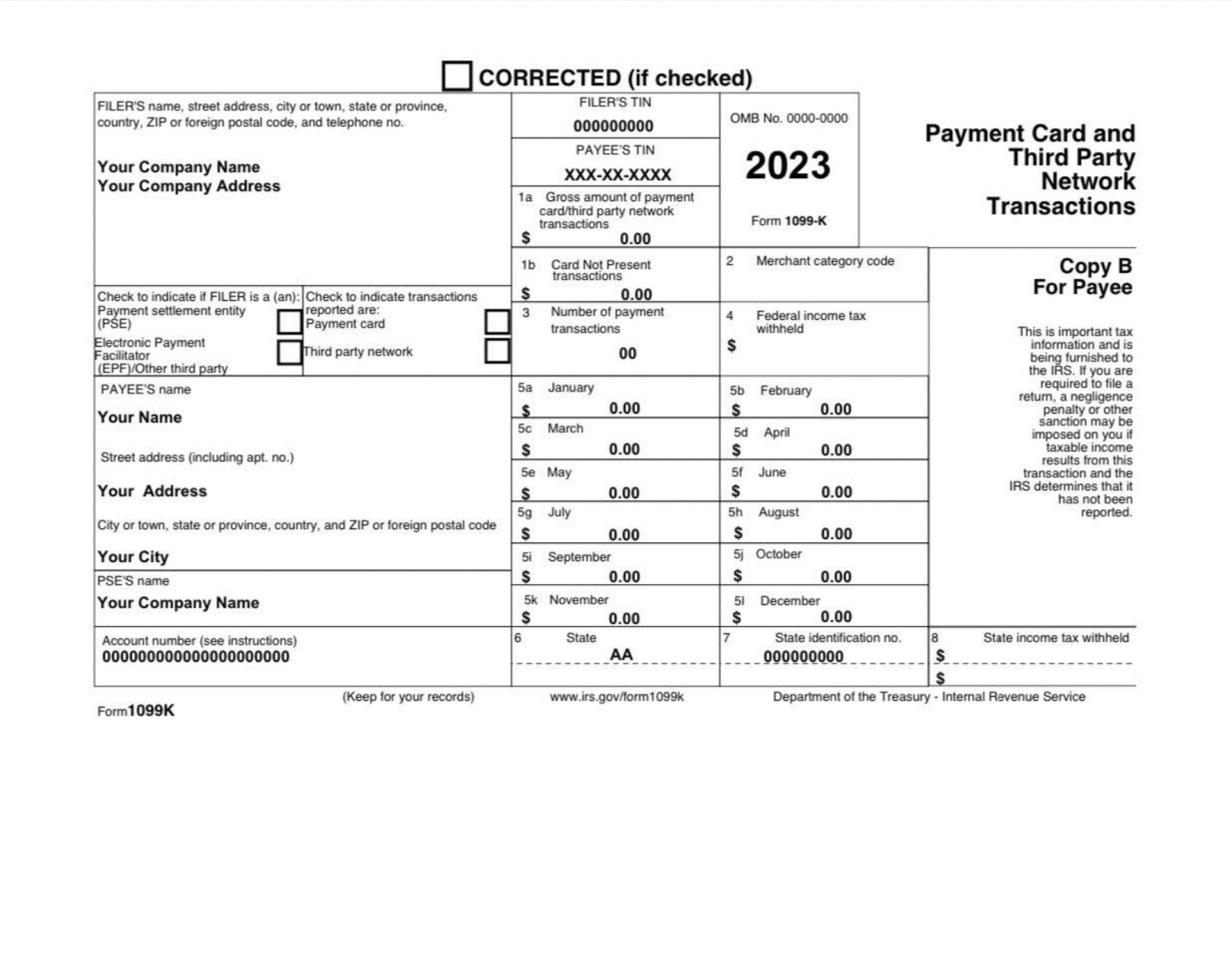

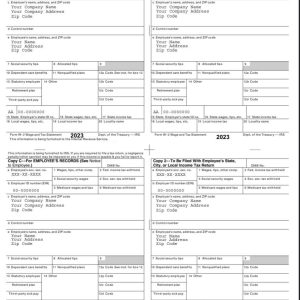

Generate accurate, professional-looking Form 1099 templates for educational, training, and visual purposes with our Custom 1099 Tax Return Generator.

This tool is ideal for freelancers, independent contractors, accountants, and small business owners who want to understand how non-employee compensation and self-employment income are reported to the IRS.

Our 1099 generator helps you visualize the process of reporting miscellaneous income, contract work, or side earnings, showing you how taxes are calculated and presented on real forms. Whether you’re learning the difference between W-2 and 1099 filings, training others, or demonstrating tax reporting procedures, this tool gives you the experience of working with realistic, compliant templates.

Designed to simplify the complexity of freelance tax documentation, this service ensures you get a professional, editable version of a Form 1099 that looks authentic — yet is strictly for lawful, educational, and demonstrative use only.

Disclaimer

This 1099 Tax Return Generator is intended for educational and visual purposes only, to help users understand how IRS 1099 forms are structured and completed.

Our templates are highly realistic but not valid for actual tax submission to the IRS or any government body.

These samples must not be used to misrepresent income or deceive any institution.

For real filings, please use official IRS 1099 forms or consult a certified tax professional.

How It Works

-

Enter Business or Payer Information – Add the business or individual’s name, EIN, and contact details.

-

Add Recipient Details – Include the contractor or recipient’s information.

-

Input Income Amounts – Enter the total payments made for freelance or contract work.

-

Review Data – Check all figures and ensure compliance with proper 1099 formatting.

-

Download & Save – Export the finished 1099 form in PDF format for training or visual presentation.

Why Choose Us

-

Authentic IRS Layout – Designed to mirror official Form 1099-MISC and 1099-NEC structures.

-

Automatic Field Population – Quickly fills calculated and repeated data for clarity.

-

Perfect for Learning – Ideal for accountants, freelancers, and tax trainees.

-

Compliant Structure – Uses IRS-aligned layouts for realistic presentation.

-

Secure and Confidential – Your entered details remain encrypted and private.

-

Fast Turnaround – Get your completed template within minutes.

-

Expert Guidance – Our team can help tailor forms to match unique learning needs.

Reviews

There are no reviews yet.